Geico v. 20161

In Geico v. 20161 filed in 2017, Geico claimed that a clinic was licensed with AHCA but it had a medical director who was “appointed in name only.”

Geico claimed that the medical director took the job because of his “advanced age.” He was 70 years old when he began in 2008 and 79 years old at the time of the lawsuit. The medical director graduated from medical school in Cuba in 1964, did not complete a residency in the US, and did not become licensed to practice medicine in the US until 1994. He had difficulty walking and since lost his driver’s license since 2014 because of his medical condition.

Also, Geico claimed that if the medical director performed systematic reviews of the files, he would have noticed that every initial examination failed to mention age, height, weight, general physical condition, location within the vehicle, and how the vehicle was impacted because those factors affect how, and to what extent, an individual is injured in an accident. I disagree that this particular information is “mandatory” but I agree it would be good to have documented.

Geico claims many patients testified in Examinations Under Oath that they were not injured in the accidents, that they were sometimes paid money to treat, that they sometimes signed blank treatment forms for dates of service they never treated for, and that the Clinic gave patients the wallet-sized card to “keep the story straight” about what treatment they received.

Interestingly, Geico mentioned that the Clinic had a PIP attorney send a letter to their SIU adjuster stating “I represent all of the patients at the Clinic who have Geico PIP insurance. Please schedule all EUO’s and communications through me.” Obviously, for an attorney to “represent” all of these people he/she would need a signed Retainer Agreement by each patient.

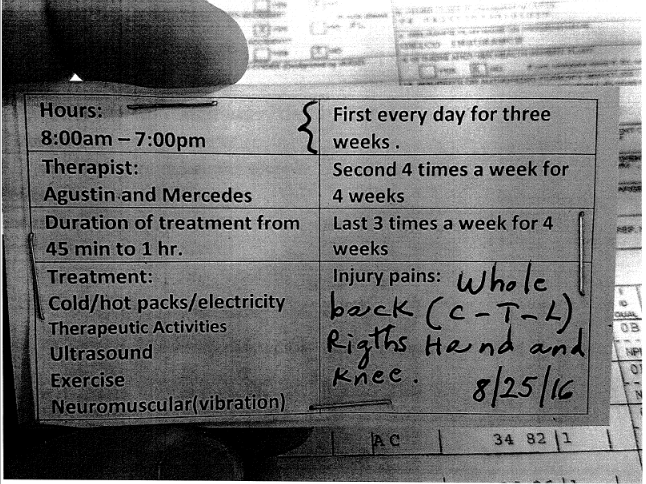

Finally, Geico claimed that if the medical director performed systematic review of the files he would have noticed that every patient received a pre-determined treatment plan which was even detailed on a wallet-sized card that “reminded” patients of (a) their symptoms; (b) the treatments they received; (c) how long it took to perform the treatments; and (4) the names of the therapists who treated them.

Take a look at the right-hand side of the wallet-sized card showing that every patient treats every day for the first three weeks; four days a weeks for the next four weeks; and three times a week for the next four weeks. This is a textbook definition of a pre-determined treatment protocol.

Geico claimed that if the medical director did his job as required by Florida Statute 400.9935 then he would have taken immediate corrective action and stopped it from happening.

DISCLAIMER

This is based on a real court case that was previously filed against a medical provider/doctor. The case number has been partially redacted and names have been changed to protect the Defendants’ names. This example is posted to help educate others on the laws and potential pitfalls. This posting is not intended to embarrass or defame anyone. I have limited the information and simplified some of the facts in the lawsuit to reflect key points and make a complicated case easier to understand. This “example” is directly from a complaint filed by an insurance company; therefore, I am using the facts THEY presented. There are always two sides to a story so please understand this is just one side of the story. This information was found through records available to the public.