State Farm v. 90210

In State Farm v. 90210 filed in 2020, State Farm claimed that a PTP was taking place.

The chiropractors referred their patients to their own MRI center which had different tax identification number from the chiropractic offices. They failed to disclose the financial interest (at least in writing). The chiropractors offered free transportation as an inducement to treat. Every patient with more than three visits was referred for MRIs and almost exclusively to their own MRI center.

The chiropractors referred their patients to their own orthopedic groups which had a different tax identification number from the chiropractic offices. They failed to disclose the financial interest (at least in writing). State Farm claims that the chiropractors could not own an orthopedic office because they could not possibly supervise the work since it was outside the scope of their license.

Almost every patient was recommended the same treatment plan which included CMT, traction, hot/cold packs, and exercise administered three times per week for four to six weeks.

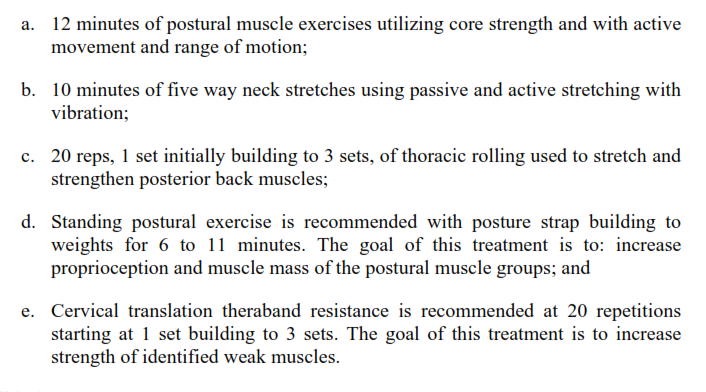

Every patient received this treatment plan of exercises:

Almost every patient who treated for more than three visits was diagnosed with an EMC. The Clinic had an internal form labeled “PIP New Patient Routing Form” which had a checklist of 18 tasks that needed to be completed and task number 9 stated “write EMC if possible.” State Farm pointed out that the form contained two sections at the top and bottom of the page which said “Do Not Scan- Not Part Of The Patient’s Medical Record” in an effort to avoid insurance companies from seeing this. Interestingly, in this case, the doctors stated that the basis for the EMC was “severe pain” and “herniated/bulging discs” but State Farm claims that is not a sufficient basis for diagnosing an EMC. I disagree.

The first task on the “PIP New Patient Routing Form” was “confirm MRI has been ordered and scheduled” which is the reason why every patient received an MRI by their third visit. Also, most patients received neck and low back MRIs even though some patients reported little to no pain to both those areas. For instance, patient LH stated her main complaint was her neck and shoulder pain, however, she received an MRI of her neck and low back. Patients were told “MRIs were needed to assess the full extent of their injuries” and the documented reason was “to rule out HNP”.

After the MRI was performed, the treating doctor wrote “a recent MRI of the cervical spine was reviewed with the patient today. Based on the finding of that scan, the patient’s diagnosis has been updated to include herniated disc(s) in the cervical spine.” No change was made to the treatment plan to reflect this new information in the MRI.

From January 2014 through March 2019, the clinics billed for three to four units of therapeutic exercise 97110 on each visit. Therapeutic exercise is a skilled therapeutic procedure designed to “develop strength, endurance, range of motion and flexibility” and is billed in 15 minute units.

In April 2019, the clinic changed the way it billed. The clinic decreased the number of units billed as therapeutic exercise and added therapeutic activities 97530 and group therapy 97150. Therapeutic activities is a skilled therapeutic procedure that involves “the use of dynamic activities to improve functional performance” and is billed in 15 minute units. Therapeutic activities can only be performed by a physician or other qualified healthcare professional, who must maintain direct one-on-one patient contact throughout the duration of the service. Group therapy is also a skilled therapeutic procedure which is performed in groups of two or more individuals and requires constant attendance of a “physician or other qualified health care professional” (defined in the CPT Manual as “an individual who is qualified by education, training, licensure/regulation (when applicable), and facility privileging (when applicable) who performs a professional service within the scope of his or her practice and independently reports that professional services.) The CPT Manual distinguishes “qualified healthcare professionals” from “clinical staff” as “a person who works under the supervision of a physician or other qualified health care professional, and who is allowed by law, regulation and facility policy to perform or assist in the performance of a specific professional service, but does not individually report that professional service.”

In EUOs, patients would state that that the doctor’s office was setup as a big room with lots of machines and, while the staff was available if there was a problem, they were not in the room and there were more patients in the room then there was staff (ie not one on one).

State Farm claimed that the work performed by CCPAs and RCAs was not compensable because it was performed by clinical staff vs qualified healthcare professionals. I disagree on that note since the work was performed by licensed CCPAs and RCAs while chiropractors were supervising them.

Therapeutic exercises is different from regular exercises because is it specifically adapted to specific patients for specific reasons. They are a specialized service which requires skillful supervision by a licensed healthcare professional. They are intended to treat a painful condition with the goal of restoring function in the patient and require constant clinical decision-making and reassessment.

State Farm complained that the patients were never informed of a co-pay or deductible. At EUOs the patients testified they never received a bill, were never informed of a deductible, and were never informed they would have to pay any money.

DISCLAIMER

This is based on a real court case that was previously filed against a medical provider/doctor. The case number has been partially redacted and names have been changed to protect the Defendants’ names. This example is posted to help educate others on the laws and potential pitfalls. This posting is not intended to embarrass or defame anyone. I have limited the information and simplified some of the facts in the lawsuit to reflect key points and make a complicated case easier to understand. This “example” is directly from a complaint filed by an insurance company, therefore, I am using the facts THEY presented. There are always two sides to a story so please understand this is just one side of the story. This information was found through records available to the public.